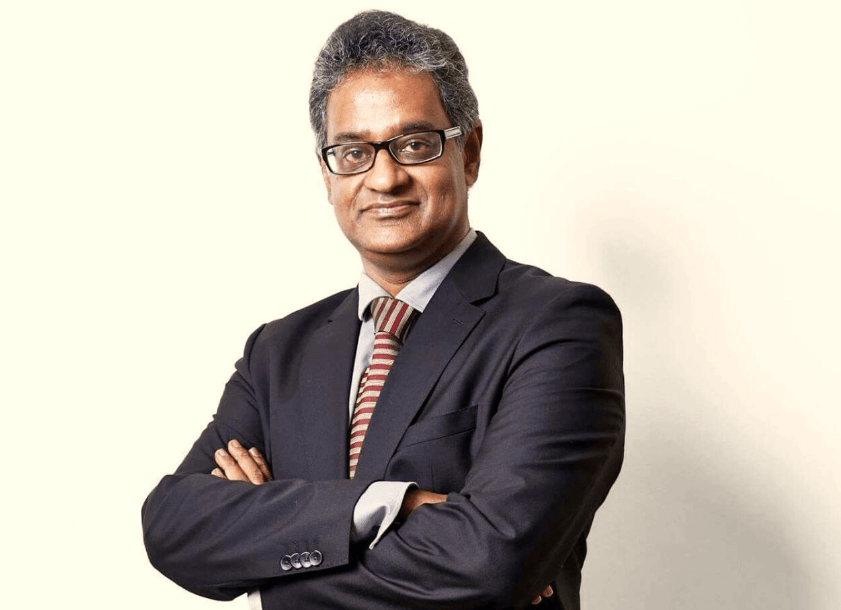

Malaysia Digital Economy Corporation (MDEC) vice president of enterprise development Gopi Ganesalingam believes Malaysian home-grown busineses have a compelling need to grow quickly and on a global tangent.

Following on the heels of Uber exiting the region and Grab taking over its operations, there is the question of whether the former was affected by a lack of appetite or other factors. Aside from that development, Gopi also cited a couple of examples on the intricacies of the local business landscape.

“First, the Malaysian used-car platform company, Carsome raised US$19 million in March 2018. The funding was led by Burda Principal Investments, through their Singapore office. StoreHub, a Malaysian company that built a Cloud-based Point of Sale(POS) application that is used by 3,000 retail stores across 15 countries, raised US$5.1 million from Vertex Ventures. Vertex, an investor in Grab, is owned by Singapore’s Temasek Capital,” he said.

He also reminded us of last year’s move by Soft Space, the Malaysian Fintech company which raised US$5 million from Japan’s Transcosmos. According to him, Soft Space was joined by Carsome, StoreHub and almost 3,000 other companies in gaining Multimedia Super Corridor (MSC) status.

“Since its inception in 1996, MDEC has been actively pursuing Malaysia’s digital agenda. This was done by initially encouraging technology companies to set up in Cyberjaya, and then bringing in shared services companies, and now by working to build globally competitive Malaysian headquarters companies,” said Gopi.

Gopi also provided examples of the first generation of Malaysian companies, many of whom achieved billion-Ringgit valuations with very little capital.

Starting with founders’ money, these companies at best raised two to three million US dollars. With few exceptions, except Grab and iflix, which raised US$170 million, Malaysian companies have not appeared on the radar of major VC firms – but times are fast changing.

Malaysian Companies Now in the Spotlight

Gopi observes that the landscape has now changed, and that money is now chasing local deals because of the ability of Malaysian companies to navigate the fragmented and tightly regulated markets of Southeast Asia.

“N2N Connect, a company that provides securities trading platforms, used its Malaysian base to grow into the region,” he cited. “We are fortunate to have a forward-thinking central bank. In addition to allowing for crowd funding platforms, and a sandbox for testing of new products, Bank Negara Malaysia (BNM) recently finalised electronic Know-Your-Customer (e-KYC) guidelines.”

The result of this was much faster and more seamless customer acquisition, with guidelines that made it possible for Internet payment provider iPay88 to launch a virtual account for the “unbanked” market.

“I am pleased that MDEC has continued to play an active role in building the ecosystem that has allowed these companies to flourish. We maintain a constant and consistent dialogue with several stakeholders, including BNM and the Ministry of Higher Education – where we led the push to introduce coding classes in schools. While we continue to work on the digitalisation agenda, we recognise an urgent need to bring larger VCs into Malaysia,” he continued.

He further mentioned that companies like Carsome, StoreHub and Soft Space are building businesses, which are like utilities.

However, he also noted that there are differences though if one were to compare them with Tenaga or Celcom, Maxis and Digi.

What are the differences?

“Utility businesses have large capex (capital expenditure) needs but their business is protected by licenses. They didn’t start off with a small bunch of customers and build the infrastructure from customer revenues; that business model just doesn’t work that way. Build a small power plant in Petaling Jaya, supply a few hundred customers and from the revenue build a megawatt plant. Big money is raised up front,” he explained.

Building Rapid Momentum

Since startups often do not have the luxury of being protected by a license, they usually start with a small bunch of customers and what is typically called a “Minimum Viable Product.”

Gopi explained that they then get feedback, gain traction and often go through a few product iterations.

“Once that has been achieved they need money – lots of it – to build the infrastructure, delivery capability and capture market opportunity ahead of potential competition,” he said.

As a further example, he cited the recent US$54 million capital raise by Zilingo, a Singapore based start-up, for an expansion into the region from their base in Bengalaru, capital of the Indian state of Karnataka.

“That’s big money! The company provides a platform for customers to browse and buy fashion products from retailers in Southeast Asia. Since inception in October 2015, Zilingo has raised US82 million, to launch in Thailand and expand into Malaysia, Indonesia, the Philippines and Vietnam. Like other platforms, the technology relies on artificial intelligence – AI – to learn buyer behaviour and then propose the “right” product,” he said.

He explained that the need to achieve scale and leverage on engineering capability was probably what led GHL Systems Berhad to acquire rival company Paysys (M) Sdn Bhd for RM80 million, with half paid in cash and the balance in shares.

He added that GHL was no stranger to corporate exercises. In 2013, it acquired e-Pay Asia Limited, a company founded by Simon Loh, now vice-Chairman of GHL. Local PE firm, Creador, sold its stake to Actis in 2017, and they are now pushing for growth in the payments, or fintech space, which is seeing a lot of new entrants.

Malaysia: Ripe for VCs

“Digitisation coupled with the porosity of borders has meant that competition lands at your doorstep almost from the word go! Scale and speed of growth are important and the fuel for that is cash – and plenty of it! This is one of the reasons why MDEC is pleased to have attracted Vickers Venture Partners, to open their Kuala Lumpur office,” said Gopi.

He mentioned that the presence of Vickers on our shores is yet another indication of investor interest in Malaysian-originated deals, yet questions if enough has been done to put Malaysia on the map. The feeling is that only time will tell, but the good news is that investors are now getting off the plane at KLIA.

“At MDEC, we are busy making sure they continue to keep Malaysia firmly on their radar. One major initiative we worked on this year is the ‘Sea Dragon Venture Platform’ initiative launched last month. Organised by PIKOM, MDEC is pleased to support this major initiative that will see 30 global VCs and corporate investors visiting Kuala Lumpur,” he said.

“It’s time to “Grow Fast and Go Global”. As we say in MDEC, we must continue to build local tech champions for the benefit of Malaysia, the region and the world,” he emphasised.

Malaysia is so close to my heart having spent over a decade there. I wish the best to Gopi. I hope one day my company expands into Malaysia and MDEC helps us do that.